No matter where you live, there are several ways to handle divorcing with a mortgage. If you or someone you love is going through a divorce, take comfort in knowing that this can be one of the easier aspects of the split depending on the situation. While it’s easier when both parties are amicable and both spouses have favorable credit ratings, there are still options for a variety of situations.

Refinance & Title Change

Mortgages are tied to your house by a deed; if one spouse can pay the mortgage on their own and wants to stay in the home, an adjustment to the deed can be made at the closing of a mortgage refinance. This may require the other spouse to attend and sign away rights on a quitclaim deed, though they might be able to obtain a Power of Attorney to have someone else sign on their behalf. It’s important to make clear to your loan officer what will be happening with the deed during the initial mortgage application.

You may need to have a written agreement in place indicating how other joint obligations will be paid after the divorce, or if alimony or child support must be included as income or an additional monthly payment on the mortgage application. This is especially vital if the spouse moving out plans on purchasing another home after the refinance is complete, because these payments may count as income or liabilities on their application as well.

Many mortgage lenders have plenty of information on their website about the qualification process. After searching mortgage companies in overland park ks, for example, research things like debt-to-income ratios, if alimony can be used as income, or the possibility of using a family member as a co-signer if credit scores are an issue. The spouse remaining on the mortgage might also choose to either rent out the home completely or lease rooms and have roommates or family members move in to help with the bills, but this likely cannot be included as income until it has been established for at least twelve months.

Sale of the Home

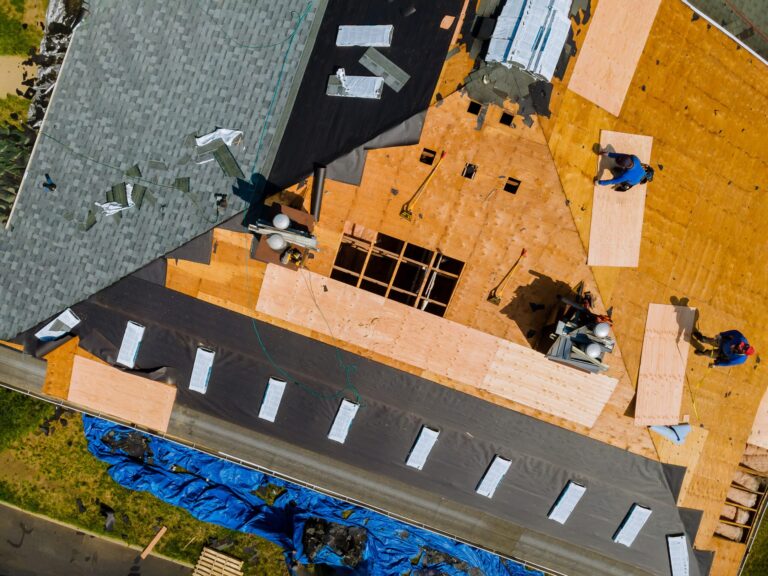

Sometimes neither spouse wants to remain in the home after the divorce. In this case, selling the home might pay off the mortgage and allow both parties to start fresh if there is ample equity available in the property. Speak with a licensed Real Estate Agent to determine the market value of your home and what improvements might make the biggest impact on that value if repairs are needed. Once you’ve received an estimate of the bottom-line profit after fees and taxes, you may need a written agreement in place determining how the money will be divided between the two of you at closing.

Written Payment Agreement

When children are involved, the split is amicable, and the house layout provides enough privacy for former spouses to remain in place leading separate lives, a written bill payment agreement is another option. These are typically part of the divorce decree, but if both parties agree to remain flexible while they come to terms with new arrangements, you could leave it out of the divorce decree and draft a separate agreement that can be amended over time. This enables both parents to still share parenting duties while clear expectations are set as to who is responsible for paying both the mortgage and utilities.

Of course, the safest option for entering into any kind of written agreement is to involve a lawyer who practices family law. Whether you search Brisbane family law services, or for a family law practice in London or New York, read up on the firm’s family law section carefully so you know what questions to ask as you move through the process.