To purchase a home, a buyer either needs to have the full purchase price available in cash, or they need to secure a home loan. Once the buyer has been approved for a loan and bought a house, they make monthly payments over a preset period to pay off the loan and the interest accrued.

To afford to purchase a home, 88 percent of buyers secured financing. Home loan amounts vary widely. Factors you must consider to determine how much you need to borrow to buy a house include the terms of the loan, the home price, the cost of essential repairs, and financial incentives for homebuyers.

Loans

The type of loan you secure will have a significant impact on your monthly payments. When you compare home loan options, you can review home loans from multiple lenders. Lenders offer fixed-rate and adjustable-rate loans. Fixed-rate loans have set interest rates that don’t change. Adjustable-rate loans have a fluctuating interest rate. This means that market conditions can cause the interest rate on the mortgage to increase or decrease.

Loan terms also differ. It’s possible to pursue a 15-year loan or a 30-year loan. The length of time you’ll need to repay the loan will impact your monthly payments, which can also affect how much money you can afford to borrow.

Price

The home’s cost is a critical factor used to determine how much money you need to borrow. The home’s cost is just one variable, however. Homebuyers who can make a down payment of 20 percent of the home price will qualify for better interest rates when applying for a loan. The down payment amount also reduces the amount of money you’ll need to borrow.

It’s possible to purchase a home with a smaller down payment, but you may need to pay additional costs. In Australia, homebuyers must put at least 5 percent of the house’s purchase price down when they make the purchase, but anyone who doesn’t put 20 percent down when buying has to take out lenders’ mortgage insurance. This insurance protects the lender. If you default on your mortgage, the mortgage insurance plan can compensate your lender for financial losses if your property has decreased in value. They’re unable to recoup the cost of the loan through the sale of the property. The extra cost of the mortgage insurance will affect your monthly expenses, which could impact how much money you can afford to borrow.

In the United States, the United States Department of Agriculture (USDA) offers mortgages for people purchasing homes in rural areas. These loans require no down payment, but qualifying buyers can only opt to take out a 30-year mortgage, which will impact the amount of interest they pay over the loan’s life.

Repairs

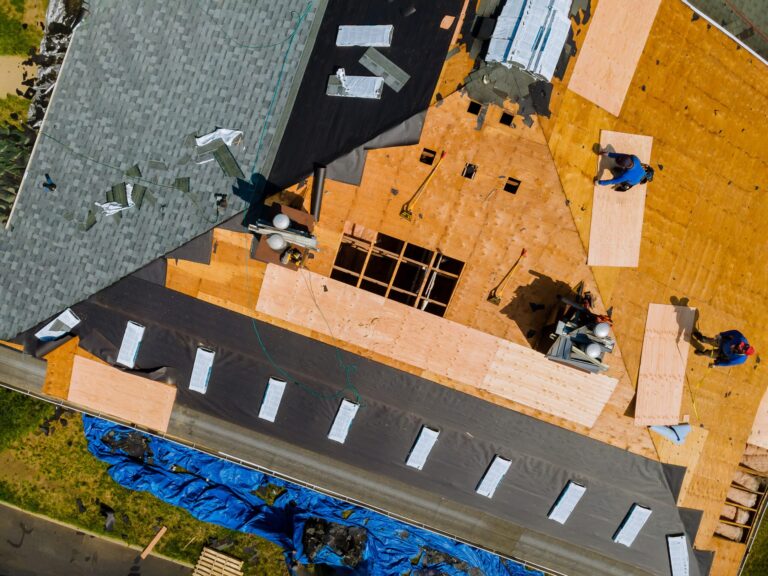

Some homebuyers opt to purchase a home and renovate it. You may need to make significant improvements if the house is in poor shape, or you may choose to purchase a home you can afford to upgrade. Some home loans, such as Federal Housing Administration (FHA) loans, allow you to finance the renovation costs.

To determine the amount you need to borrow, you must add the cost of planned repairs to the house’s purchase price. If you plan to replace the windows, Google “vinyl windows in Houston” to locate a reputable window installation company that can install energy-efficient windows. You’ll be able to choose from an array of window styles, including bay, picture, and sliding windows. One of the benefits of installing new windows is that they’re insured for 20 years. Installing energy-efficient windows will reduce your heating and air conditioning costs and increase the value of your home.

Incentives

Financial incentives may also impact the amount of money you need to borrow. In Australia, first-time homebuyers can qualify for grants to help cover the cost of purchasing a home. Grant amounts range from $10,000 to $26,000 and are determined by the location of the house you’re purchasing.

You must consider the type of loan you’re securing, the home’s cost, and the amount of money you can put down to determine how much you need to borrow to buy a home. The cost of renovations and financial incentives that can offset the cost of buying your home to determine may also affect the final amount of your home loan.