One of the most expensive purchases most people will buy in their lifetime is a house. A mortgage payment, therefore, is one of the biggest expenses for a homeowner. Most homeowners want to try to mitigate other out-of-pocket costs with a home warranty. Not everyone has enough cash flow to self-insure, so they look into a home warranty. These warranties can be a great way to help cover an expensive repair, but it’s good to check for a few things before purchasing coverage.

What the Warranty Covers

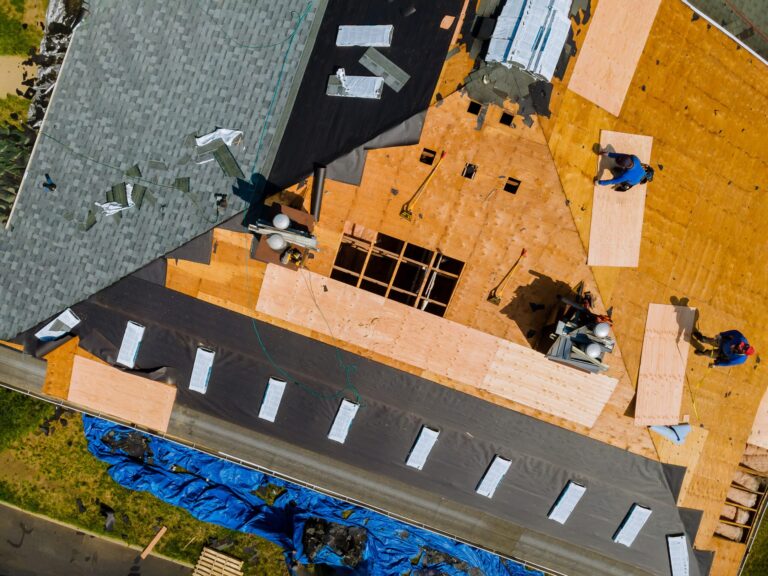

This may sound simple, but you need to do your due diligence in thoroughly reading the warranty. Many first-time buyers can get lost in the process of buying a home and rush to the next step of the process. This is the easiest way to overlook what the warranty covers. Take your time. You’ll want to be thorough and precise. Looking for your more expensive items like the roof, air conditioning unit, and foundation are good places to look for coverage.

Limits to the Agreement

When you go into a new warranty contract as the property owner, you will have some limitations to what you can expect from the contract depending on what you do with the house. For many people, you have the desire to turn your house into a rental. In many situations, this can be a good idea. However, you’ll want to look at how, or if, having a renter in the home can be a manageable endeavor for you.

The rental income can be helpful, and even being a property manager can be appealing, but you’ll want to gauge whether or not you should get a warranty based on how having a tenant changes things. Being an investment property doesn’t automatically change the coverage, but it might.

Additionally, there might be obligations you have to fulfill for an HOA (homeowner’s association) with your home. Keeping exteriors updated and maintained is a common request. If your HOA is instructing you to update your outdoor unit, but it isn’t malfunctioning, it might not be covered in the warranty.

Excluded Items

A common reason to read the language of the contract closely is due to excluded items. This is because contracts can be misleading. For example, perhaps your attic is covered in the warranty, but the roof is not. The roof leaks and causes damage to your new home, but you aren’t covered because the leak was from the roof, not the attic.

This could also come in the form of hot air blowing from your air conditioner. Perhaps the warranty only covers certain parts of the HVAC system or doesn’t handle low refrigerant issues. Know what isn’t covered before you sign anything.

Which Items are Already Covered Elsewhere

First thing, this can be tricky to know. Mainly because a new house can have warranties from the manufacturers on individual materials. Windows, dishwasher, condenser, ducts, and other items can each have individual coverage you would need to track. Insurance could also cover a lot of what the warranty is also protecting. Try to get as much information on the finances for the property as you can. There is a decent chance you are covered in other ways.

The Final Cost

With most major purchases, it’s good to understand the final cost. Your real estate agent should be able to help you get a clear idea of what this would be for the warranty. But it isn’t just the final number on the warranty. You’ll also want to know if there are any tax implications for purchasing one. There could be deductions or other right offs that might lower your “final cost.” Get an understanding of your all-in price for your home with the warranty.