Whether you’re in the legal industry or you’re the senior managing director at a marketing firm, there are plenty of finance tips you should be following. Over the last year, the United States’ economy has taken some alarming twists and turns. These have directly impacted numerous businesses and created ongoing complications.

As such, key players in the finance sector, like Mark Wiseman, have conducted reviews of the economy and have several finance tips that entrepreneurs, decision-makers, and executives alike should consider to keep their businesses running smoothly.

1. Have an emergency fund.

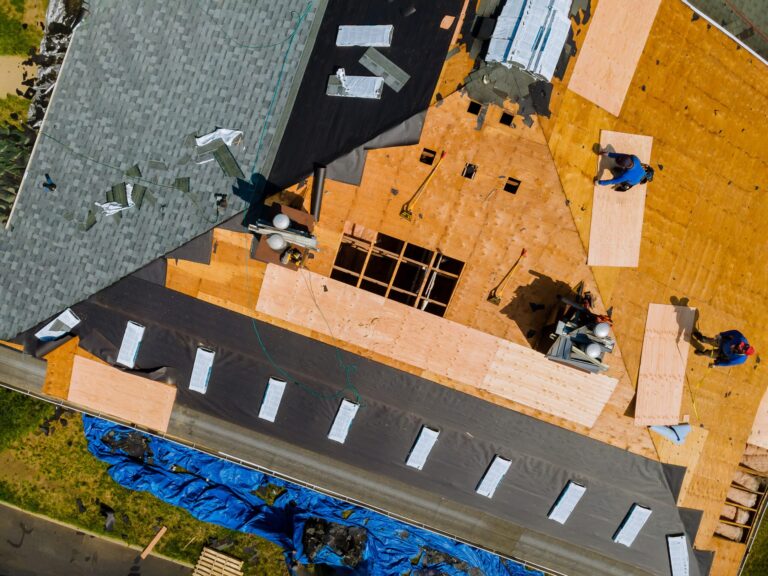

Mark Wiseman suggests that an emergency fund is perhaps one of the most important steps you can take for the financial health of a business. As the year has shown us, every industry, from real estate to law firms, has struggled with economic growth. Typically, this would mean three-to-six months of living expenses to help you in case of a difficult time. However, with COVID-19, it’s beneficial to have more capital on hand whenever possible. While you don’t need to go so far as to set up a private equity fund, having emergency cash available is critically important.

2. Set aside funds for legal advice.

In these unprecedented times, as the United States works to navigate the country’s future during COVID-19, there’s a great deal of uncertainty when it comes to litigation. Various organizations are experiencing a greater need for assistance from the legal industry these days. It’s important to ensure you have a good relationship with your law firm, especially if you’re outside of their typical practice areas. The Global Legal Law Firm, in particular, is one of the top law firms in the world, not just the United States.

3. Invest properly for risk management.

Wiseman often advises that diversified investment can make a large impact on your business’s health and risk management. This is important whether you’re a senior advisor or you’re relatively new to entrepreneurship. Especially if you’re setting up your business in a hotspot like Los Angeles or New York, it’s important to work to expand your portfolio and build economic policies that will build toward the future.

4. Hire quality advisors.

You don’t need to have a direct line to the Canadian Finance Minister or the Global Investment Committee, but a top work policy should be to spend hiring money on individuals who can make a difference in your financial prospects. Whether you’re hiring advisory roles for a member of the advisory council, or you’re working with the Capital Markets Institute to find someone who has served on the board of several non-profit organizations, investing in quality over quality can pay solid returns.

5. Go as paperless as possible.

Wiseman, in particular, knows how almost every industry is becoming far less cash-centric. Cash can lead to unnecessary expenses, especially if you’re working with digital intellectual property. In the United States, cash usage has gone down significantly. Of course, depending on the kind of devices you use to conduct business, it’s incredibly important to make sure you have a strong phone password. Whether you’re a landlord or you’re in the legal industry, your reference ID needs to be secure enough to thwart data breaches. Even the largest law firm will have difficulty protecting you if you don’t secure customer data. Write yourself a memo for this one, if you need to.

Of course, these are just a handful of useful financial tips. Whether you’re working on switching from JavaScript to a more potent programming language or you’re taking courses from Hillhouse Capital or Blackrock’s Global Executive Committee, there are ways to improve financial health. Narrow down your practice areas, invest in the future, and always work to ensure that you’re staying ahead of the economical curve.